Ecb Deposit Rate

- The ECB/OECD does not take responsibility for any replication of the content of the Software, or any other form of redistribution. 'Euro area statistics' is a service provided by the European Central Bank (ECB) and the National Central Banks (NCBs) of the Eurosystem. You are invited to.

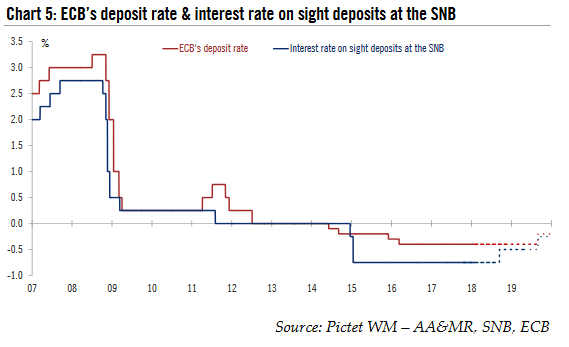

- The ECB last cut its deposit rate in September 2019, to -0.50%.

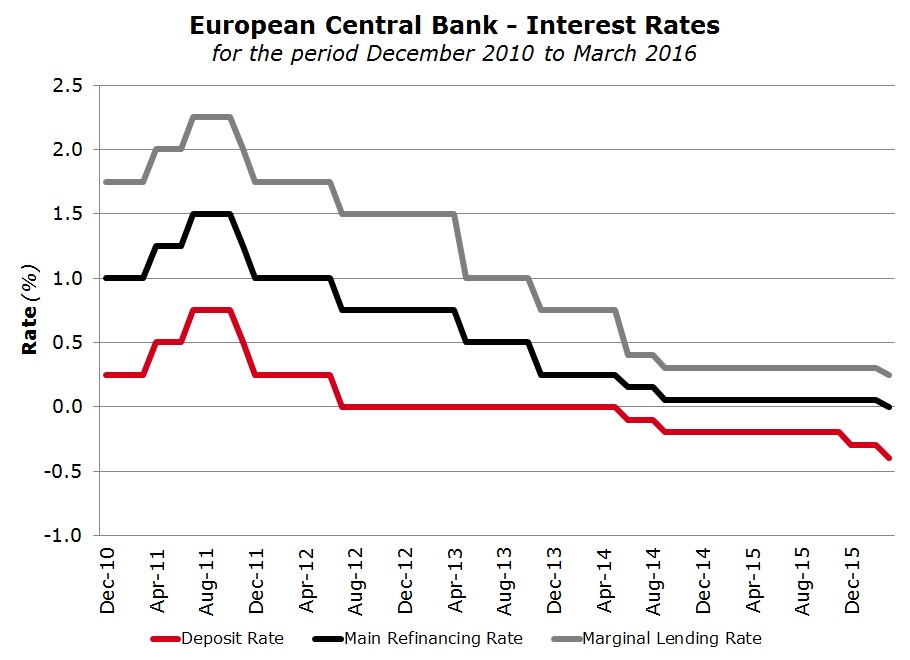

Let’s start at the beginning. The main key ECB rate is the refinancing rate. At the time of writing, the ECB refinancing rate is 0.050%, its lowest level ever. What does this 0.050% rate mean?

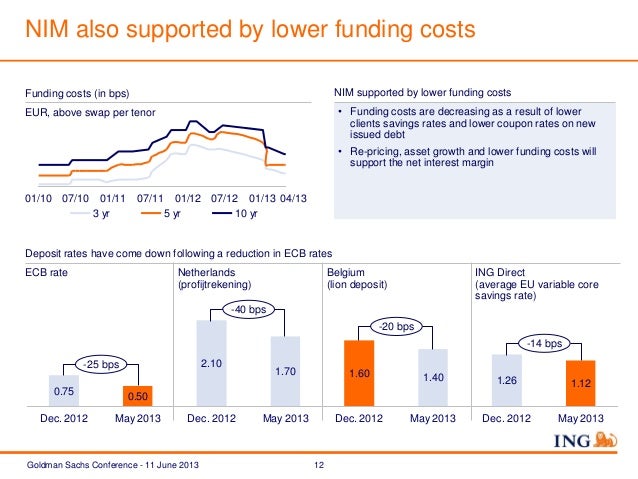

The two other key ECB rates are the overnight deposit rate (-0.20%) and the overnight marginal lending rate (0.30%). The first is the interest rate paid by the ECB to banks having a deposit (for the moment, it is the opposite because the rate is negative). Negative Interest Rates Imposed by ECB Force Banks to Turn Away Customer Deposits. Banks in Germany have been telling customers to take their deposits elsewhere as they can no longer sustain the cost of parking money at the ECB, the Wall Street Journal reported Tuesday. The central bank has been imposing negative interest rates. The ECB introduced negative rates in June 2014, lowering its deposit rate to -0.1% to stimulate the economy. Describing the euro zone economy as mired in a period of “protracted” weakness, ECB.

Ecb Deposit Rate Tiering

Ecb Deposit Rate Cut

To keep the prices stable (inflation below, but close to, 2%) the European Central Bank uses several monetary policy instruments to steer interest rates and manage banking liquidity. The most traditional operations are what we call the Main Refinancing Operations (MRO). When liquidity is needed, a bank can borrow directly from the ECB. Every week, banks of the Eurozone go (virtually) to the ECB desk to borrow money at the refinancing rate fixed by the ECB (0.050%). The loan is made under the form of a Repurchase Operation (Repo). The bank sells security assets to the ECB and borrows money. One week later, the bank gives the money back with interest to the ECB and recovers its security assets.

Ecb Overnight Deposit Rate

The two other key ECB rates are the overnight deposit rate (-0.20%) and the overnight marginal lending rate (0.30%). The first is the interest rate paid by the ECB to banks having a deposit (for the moment, it is the opposite because the rate is negative). The second is the rate paid by banks to the ECB when they want to use overnight credit outside the refinancing operations.